Freelance Artist Invoice Template: A Comprehensive Guide for Creative Professionals

As a freelance artist, managing your finances and ensuring timely payments are crucial for your business’s success. A well-structured freelance artist invoice template is an indispensable tool that streamlines the billing process, maintains professionalism, and helps you get paid promptly. This comprehensive guide will walk you through everything you need to know about creating and using a freelance artist invoice template, ensuring you present your services in a clear, organized, and professional manner.

Why Use a Freelance Artist Invoice Template?

Using a dedicated invoice template offers numerous benefits for freelance artists:

- Professionalism: A professionally designed invoice reflects positively on your business, demonstrating attention to detail and commitment to your clients.

- Organization: A template ensures consistency in your billing process, making it easier to track payments and manage your finances.

- Efficiency: Templates save time by eliminating the need to create invoices from scratch each time.

- Clarity: A well-structured invoice clearly outlines the services provided, payment terms, and other essential details, minimizing potential misunderstandings with clients.

- Legal Protection: A detailed invoice serves as a legal record of the agreement between you and your client, providing protection in case of disputes.

Essential Elements of a Freelance Artist Invoice Template

A comprehensive freelance artist invoice template should include the following elements:

Your Contact Information

Include your name, business name (if applicable), address, phone number, and email address. This information allows your client to easily contact you if they have any questions or concerns.

Client’s Contact Information

Include the client’s name, company name (if applicable), address, and contact person. Accurate client information ensures that the invoice reaches the correct recipient.

Invoice Number

Assign a unique invoice number to each invoice. This helps you track invoices and payments, and it also provides a reference point for communication with your client. A simple sequential numbering system (e.g., 2023-001, 2023-002) works well.

Invoice Date

Clearly state the date the invoice was issued. This is important for tracking payment deadlines and managing accounts receivable.

Payment Due Date

Specify the date by which the payment is due. Be clear about your payment terms (e.g., Net 30, Net 15, Due Upon Receipt). Consider offering early payment discounts to incentivize prompt payment.

Description of Services

Provide a detailed description of the services you provided. Be specific about the type of artwork, the scope of the project, and any relevant details. This section should be clear and concise, leaving no room for ambiguity.

Hourly Rate or Project Fee

Clearly state your hourly rate or the agreed-upon project fee. If you are charging an hourly rate, include the number of hours worked. If you are charging a project fee, ensure that the fee accurately reflects the scope of work and any agreed-upon revisions.

Subtotal

Calculate the subtotal by multiplying the hourly rate by the number of hours worked or by listing the project fee. This is the amount before any taxes or discounts are applied.

Taxes (if applicable)

If you are required to collect sales tax, clearly state the tax rate and the amount of tax being charged. Ensure that you comply with all applicable tax laws and regulations.

Discounts (if applicable)

If you are offering any discounts, clearly state the discount amount and how it was calculated. This could be a percentage discount or a fixed dollar amount.

Total Amount Due

Clearly state the total amount due, including all taxes and discounts. This is the final amount that the client needs to pay.

Payment Instructions

Provide clear instructions on how the client can pay you. This should include your preferred payment methods (e.g., PayPal, bank transfer, check) and any relevant account information. Consider offering multiple payment options to make it easier for clients to pay you.

Terms and Conditions

Include your terms and conditions, such as late payment fees, copyright information, and cancellation policies. This section should be clear and concise, protecting your rights as a freelance artist. Consult with a legal professional to ensure that your terms and conditions are legally sound.

Notes (Optional)

Include any additional notes or information that you want to communicate to your client. This could include a thank you message, a reminder about upcoming projects, or any other relevant information.

Creating Your Freelance Artist Invoice Template

You have several options for creating your freelance artist invoice template:

- Microsoft Word or Excel: You can create a simple invoice template using Microsoft Word or Excel. These programs offer basic formatting options and are readily available to most users.

- Google Docs or Sheets: Google Docs and Sheets provide free alternatives to Microsoft Word and Excel. They are cloud-based, making it easy to access and share your invoice template from anywhere.

- Online Invoice Generators: Numerous online invoice generators are available, many of which offer free or low-cost options. These generators often provide pre-designed templates and automated calculations.

- Accounting Software: Accounting software like QuickBooks or FreshBooks offers robust invoicing features and can help you manage your finances more effectively. These programs typically require a subscription fee.

When choosing a method, consider your budget, technical skills, and the complexity of your invoicing needs.

Tips for Effective Invoicing

To ensure that your invoicing process is efficient and effective, consider the following tips:

- Send Invoices Promptly: Send invoices as soon as possible after completing a project or service. This increases the likelihood of getting paid on time.

- Be Clear and Concise: Ensure that your invoice is easy to understand and free of errors. Double-check all information before sending it to your client.

- Follow Up on Overdue Invoices: If an invoice is overdue, send a friendly reminder to your client. Be professional and persistent in your follow-up efforts.

- Keep Accurate Records: Maintain accurate records of all invoices sent and payments received. This will help you track your income and expenses and make tax preparation easier.

- Offer Multiple Payment Options: Providing clients with multiple payment options (e.g., PayPal, bank transfer, credit card) can make it easier for them to pay you promptly.

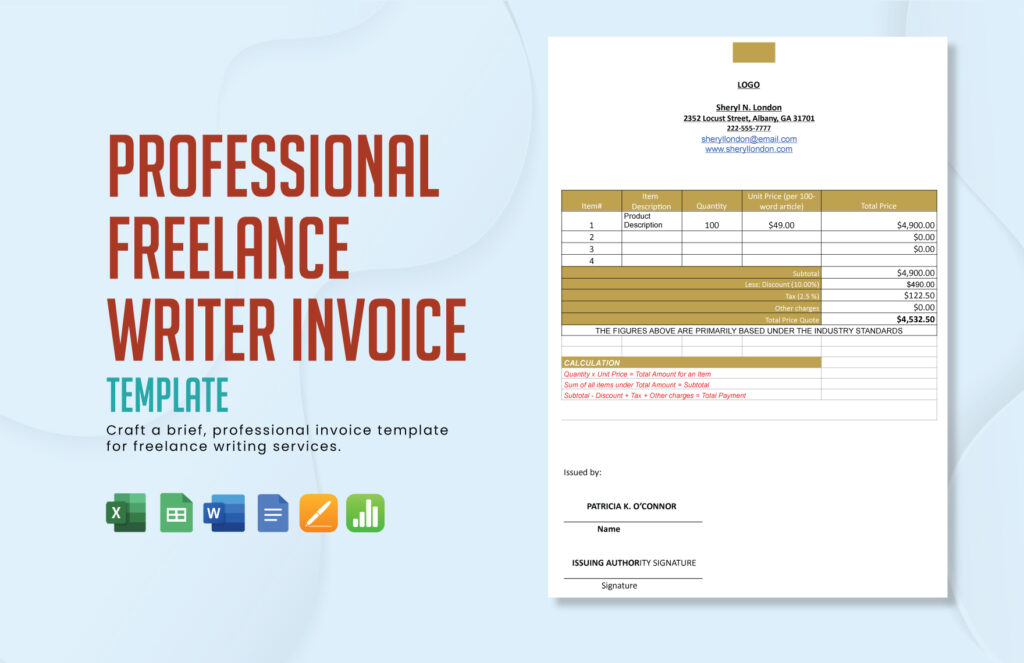

Example Freelance Artist Invoice Template (Simplified)

Here’s a simplified example of what your freelance artist invoice template might look like:

[Your Name/Business Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

Invoice

Invoice Number: 2023-001

Date: October 26, 2023

Due Date: November 26, 2023

Bill To:

[Client Name/Company Name]

[Client Address]

[Client Contact Person]

Description | Quantity/Hours | Rate/Price | Amount

— | — | — | —

Illustration Design | 1 | $500.00 | $500.00

Logo Design | 1 | $300.00 | $300.00

Revisions | 4 hours | $75.00/hour | $300.00

Subtotal: $1100.00

Sales Tax (if applicable): $0.00

Total: $1100.00

Payment Instructions:

Please remit payment via PayPal to [Your PayPal Email Address].

Terms:

Payment is due within 30 days of the invoice date. Late payments will incur a 5% late fee.

Leveraging Software for Invoice Management

While basic templates are useful, consider investing in specialized invoicing software or accounting software for more advanced features. These tools offer benefits such as:

- Automated Invoice Generation: Generate invoices quickly and easily, often with pre-populated client information and service descriptions.

- Payment Tracking: Track invoice statuses, payment dates, and outstanding balances in real-time.

- Automated Reminders: Send automated payment reminders to clients to reduce late payments.

- Reporting and Analytics: Generate reports on your income, expenses, and profitability to help you make informed business decisions.

- Integration with Other Tools: Integrate with other business tools, such as project management software and CRM systems, to streamline your workflow.

Popular options include FreshBooks, QuickBooks Self-Employed, and Zoho Invoice. Evaluate your needs and budget to choose the best solution for your freelance artist business. [See also: Best Accounting Software for Freelancers]

The Importance of Customization

While using a template is a great starting point, don’t be afraid to customize it to reflect your brand. Add your logo, use your brand colors, and tailor the language to match your unique voice. Customization not only enhances your professionalism but also reinforces your brand identity. A well-branded freelance artist invoice template can leave a lasting impression on your clients.

Avoiding Common Invoicing Mistakes

To ensure a smooth and professional invoicing process, avoid these common mistakes:

- Incorrect Contact Information: Double-check all contact information to ensure accuracy.

- Missing Invoice Number or Date: Always include a unique invoice number and the invoice date.

- Unclear Descriptions: Provide clear and detailed descriptions of the services provided.

- Incorrect Calculations: Double-check all calculations to ensure accuracy.

- Vague Payment Terms: Clearly state your payment terms, including the due date and any late payment fees.

By avoiding these mistakes, you can minimize the risk of payment delays and maintain a positive relationship with your clients.

Conclusion

A well-designed freelance artist invoice template is an essential tool for managing your finances and ensuring timely payments. By including all the necessary elements, customizing it to reflect your brand, and avoiding common mistakes, you can create a professional and efficient invoicing process. Invest the time to create a robust template, and you’ll reap the rewards of improved cash flow, better client relationships, and a more successful freelance artist business. Remember to regularly review and update your freelance artist invoice template to reflect changes in your business practices or legal requirements. [See also: Pricing Strategies for Freelance Artists]